While obtaining that loan when you find yourself unemployed, feel additional cautious about what you put onto your loan app, what bank you choose, and how your control your funds.

step one. Identify all resources of money in your application for the loan

You will possibly not enjoys uniform paychecks at this time, but when you have income coming in at all the, be sure to become they in your loan application; it can increase your probability of approval.

dos. Thought an associate-big date work otherwise freelance functions

If you’re not exposing far dollars, consider taking up an associate-go out employment or front side hustle and also make extra money one which just make an application for your loan. Apps eg Uber, Lyft, Like, and you will Shipt the give admission-height part-day gigs, and you will Upwork and you will Fiverr is a good idea loan places Danielson systems so you can get freelancing ventures.

3. Stay on greatest off bank card money and other finance

Loan providers will study your credit rating and you will payment record. If you have fell about or defaulted towards most other bills, loan providers would-be hesitant to approve you for a financial loan. Do your best to invest punctually, everytime, having playing cards and other money, even if this means merely deciding to make the lowest fee.

I would suggest setting up automatic monthly obligations to spend the minimum fee due; which covers you from lost a fees and you may damaging your own credit.

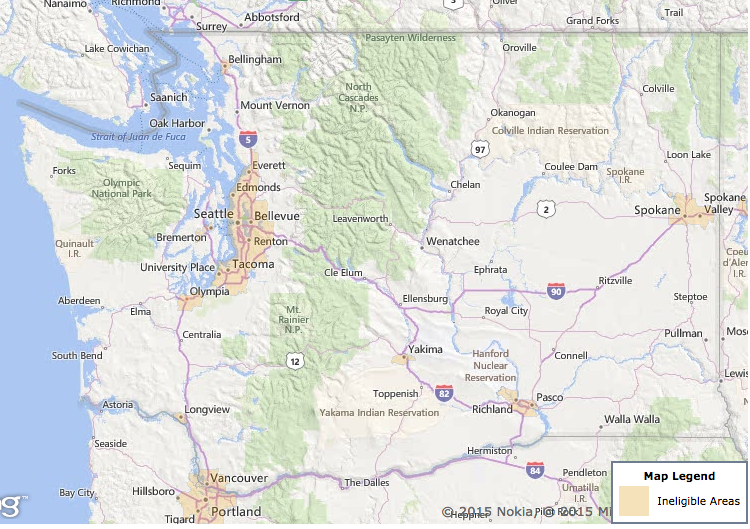

cuatro. Choose a lender that aim people like you

Particular loan providers merely loan to large-borrowing from the bank consumers, and others reduce strict requirements and tend to be prepared to procedure loans so you’re able to consumers which have mediocre if not less than perfect credit results. In the event your get is on the low side, definitely look around to suit your lender. Apply having an industry (like Legitimate), or discover a lender you to definitely goals lower-borrowing from the bank individuals to keep on your own some time problems.

5. Include a great cosigner or co-applicant to your financing

Using that have an effective cosigner or a great co-candidate will help alter your test at the getting financing-particularly when they have a stable income and good credit. Just make sure they are aware what they are signing up for: They will be on link on the obligations when you are unable to repay it.

If you are selecting this type of alternatives, investigate courses below for more information on such finance and you may examine businesses that render all of them:

If you get a personal loan if you’re out of work?

It’s also wise to look around for your mortgage. Rates, terms and conditions, repayment periods, and other info can vary because of the bank, and you can researching the options can indicate major deals throughout the years.

While willing to shop around and also have remedies for new issues more than, have a look at ideal personal loans to obtain an option you to definitely suits you.

I will suggest consulting with a financial therapist otherwise an economic professional, dependent on what you can afford and whether you have got a keen founded reference to one to. Be sure the mortgage possess a certain objective while learn what you will use they to possess. Preferably, up until now, it is to have a desire and not a need.

Option choices for people with zero job

- Cash advance application: Apps promote short fund so you can pages according to its earnings and you may asked salary. Payday loans programs can be useful in emergencies, nevertheless they commonly include costs, and you can have to repay the advance within this months or on the next pay check.

- Secured personal loans: A protected personal bank loan is actually an alternative when you have some type of equity, such as a car, holds, otherwise providers devices. Since they’re protected by a secured item, they often come with all the way down costs and you can larger loan quantity than traditional unsecured unsecured loans. The fresh drawback would be the fact their investment is at chance any time you default to the loan.