A house guarantee loan can also be open this new monetary options getting property owners. Because of the experiencing the value of your home, you have access to fund getting home improvements, debt consolidating, otherwise biggest expenses, all of the when you find yourself experiencing the aggressive pricing for sale in the state.

This short article delve into new particulars of family collateral funds for the Minnesota, plus how they work, the huge benefits they offer, while the trick standards you ought to see. Regardless if you are considering a vintage family collateral loan (HELOAN) or a flexible house security line of credit (HELOC), you’ll find out ideas on how to browse the options and optimize your residence’s possible.

A home equity loan makes you borrow secured on the fresh collateral in your home, which is the difference between their house’s worth and people a fantastic financial harmony. Which financing brings a lump sum payment of cash you will need to pay over a fixed identity which have lay monthly obligations, making it easy to plan your allowance.

When you are questioning exactly how a property equity loan functions, view it due to the fact a moment financial. The quantity you might acquire depends on the house’s collateral, credit score, and you can income. Normally, loan providers require that you manage no less than ten-20% security of your home after the loan.

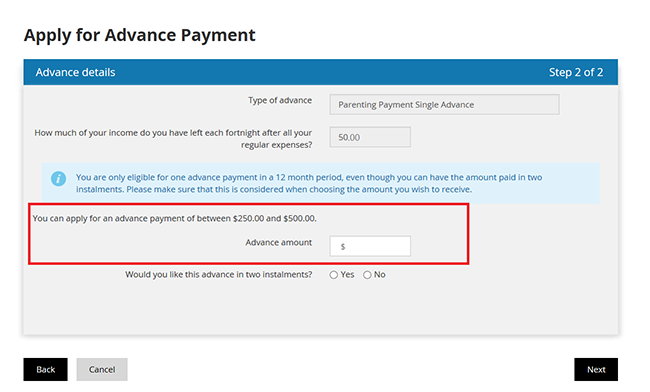

To apply for a home security financing, you’ll need to gather certain monetary records, as well as paystubs, W-2s, and you can taxation statements. While thinking-employed or has varied earnings, check out the lender declaration HELOAN. Which family collateral mortgage makes you be considered having fun with step one-two years off bank statements, simplifying the method and you can providing significantly more freedom.

Think of, with your family once the collateral function you risk foreclosure for those who are not able to make money. Very, its crucial to consider carefully your finances and you can future plans in advance of investing in a house security financing during the Minnesota.

Form of Domestic Guarantee Financing

There have been two form of house collateral finance within the Minnesota: the traditional house equity financing as well as the house equity line of borrowing (HELOC).

Property collateral loan now offers a lump sum payment of money that have a predetermined interest and you may monthly obligations. This type of financing is ideal for tall expenditures including house renovations otherwise debt consolidation. House security loan rates for the Minnesota may differ, so it’s wise to compare offers.

https://paydayloanalabama.com/memphis/

On top of that, a house collateral credit line (HELOC) services more like credit cards. You might acquire as needed, doing an appartment restriction, and simply pay appeal on which you utilize. HELOCs normally have adjustable prices, which can be advantageous if the prices are reasonable but may go up over the years.

About an effective HELOC vs. a house guarantee mortgage, think about your monetary needs and payment choice. Minnesota domestic collateral fund give balances, while HELOCs offer autonomy. You will need to choose the choice you to definitely most closely fits your financial condition and you can requirements.

Pros and cons away from Minnesota Home Guarantee Money

House collateral finance inside Minnesota will likely be a powerful way to availability money, however it is crucial that you weigh the huge benefits and you will cons:

Experts out-of household security financing:

- Repaired rates: Many Minnesota household security fund render secure cost, and come up with cost management much easier.

- Lump sum payment: You get the entire loan amount upfront, which is perfect for higher costs.

- Prospective taxation pros: Appeal could be taxation-allowable in the event that useful for home improvements.

- Quick monthly installments: As compared to higher-appeal credit cards otherwise unsecured loans, brand new payment per month to your a property guarantee loan shall be apparently lowest.

- Maintain first-mortgage: You can access their house’s equity while keeping your lower-speed first mortgage intact.

Drawbacks from home collateral funds:

- Risk of foreclosures: Your home is guarantee, very overlooked money can lead to foreclosures.

- Financial obligation increase: You may be incorporating alot more personal debt toward existing financial, and this can be risky if the home prices drop off.

- High interest levels: Family guarantee mortgage cost within the Minnesota are higher than people to have a first traditional financial.

Just how to Be eligible for a home Collateral Mortgage within the Minnesota

Qualifying to possess a property guarantee loan within the Minnesota involves appointment secret standards. Knowledge these may make it easier to prepare and increase your odds of acceptance. Here’s what your generally speaking need to be considered:

- Loan-to-well worth (LTV) ratio: The newest LTV proportion try determined of the isolating the amount you owe by the house’s appraised worthy of. Including, if for example the mortgage balance try $120,000 as well as your home is appraised during the $160,000, your LTV ratio could well be 75%. Loan providers generally prefer an enthusiastic LTV proportion away from 80% otherwise lower to attenuate exposure.

To possess an easier application processes, consider utilizing the latest Griffin Gold application. It will help your that have cost management and you can funding, making it simpler to handle the money you owe for the application techniques.

Get property Security Mortgage within the Minnesota

Trying to get a property security mortgage from inside the Minnesota will be a wise monetary circulate, whether you are seeking loans renovations, combine loans, otherwise supply extra money. From the making use of their home’s equity, you might safer financing with competitive prices. To begin with, be sure you meet with the secret criteria, such as that have sufficient home guarantee, a good credit score, and you can a manageable obligations-to-earnings ratio.

To try to get a property equity financing from inside the Minnesota, contemplate using Griffin Resource. Griffin Financing have a tendency to direct you through the application techniques, helping you optimize your house security. Do the 1st step right now to discover your residence’s economic possible.