Make use of a homes financing, a type of financing you to definitely, such as for example good RenoFi Mortgage, allows you to obtain considering your residence’s future well worth. However, we don’t strongly recommend it. As to why? Because you’ll not only be forced to re-finance for the a top rates, you will deal with large closing costs and just have to go through a complicated mark process for the contractor to obtain paid back. As well as that it need, particular builders in reality will not work on these mortgage totally.

Let us plus make clear something; swimming pools can’t be financed playing with a keen FHA 203k Loan, just like the these are sensed luxury facilities on the list of restricted advancements that are not permitted.

A comparable is not necessarily the situation having HomeStyle Fund, in the event, and is also it is possible to to make use of such as a means from pond financing.

These fund have multiple disadvantages, also higher rates, a requirement to re-finance, and you will a long and tricky process that often causes waits and higher charges.

You can easily usually see one signature loans was offered on property owners as the do-it-yourself loans’ otherwise much more specific activities, such as for instance a pool loan.

But do not be conned on convinced that these types of finance manufactured specifically for the sort of investment it is possible to embark on. Not really.

Such products are large desire unsecured signature loans sold to own a particular fool around with as opposed to becoming some thing novel otherwise giving collection of advantages over most other alternatives.

And even though you may find reported pond financing, do it yourself finance, or any other unsecured loans which claim to help you to use up to help you $100,000 or higher, this is certainly a keen upwards to’ count which is merely doable from the an extremely few from individuals.

The truth is, the total amount that one may obtain with the help of our signature loans is actually always centered on your revenue, credit rating, plus personal debt-to-income ratio. Thus many people can get limited borrowing from the bank energy which have these types of loan, and you can face shockingly high rates of interest, have a tendency to over 15%.

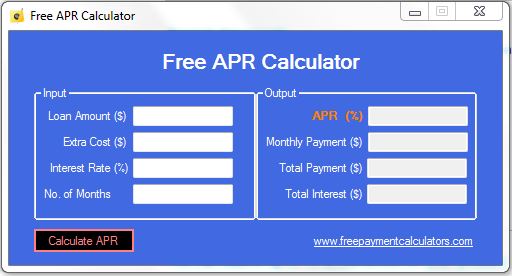

And also to help you understand the perception these large rates may have, need a glance at the difference in monthly installments on a $50k financing lent over ten years at these two rates – 15% and 8%.

Less interest mode lower monthly installments payday loans online Wisconsin, it is therefore on your own desire to get the option that delivers you the borrowing from the bank power to obtain a complete amount borrowed you you prefer at lowest you’ll be able to prices.

Basically, people really should not be playing with a personal loan to invest in its the pool, neither would be to handmade cards qualify for the very same reasons.

Rates getting Pond Financing

The easiest way to let decide which resource choice is perfect for you was evaluating mortgage cost – although not, you should just remember that ,:

- Pricing are very different, and you will your relies on the money you owe. The fresh new rates you see on the web may not mirror the individual choice.

- Cannot glance at interest levels as a way to examine loan possibilities in the separation. Each loan option have various other words, possible settlement costs and other costs, draws and you may inspections, or other techniques.

Facts to consider getting Share Financing

Pools is fast getting probably one of the most preferred enhancements that individuals need to make to our residential property, and therefore comes since the not surprising that.

Prior to you give your own specialist new wade-to come, you will want to manage to pay for the installation of your brand new pool, that is where is the points that you ought to keep in brain when considering the choices:

- What sort of pool looking for and you may what is actually they planning pricing