A non-value added https://1investing.in/ is an activity where there is an opportunity of cost reduction without reducing the product’s service potential to the customer. In other words, it is an activity that, if eliminated, will not reduce the actual or perceived value that customers obtain by using the product or service. For example, storage and moving of raw materials, reworking or repairing of products etc. Value-added activities enhance the value of products and services in the eyes of the organization’s customers while meeting its own goals.

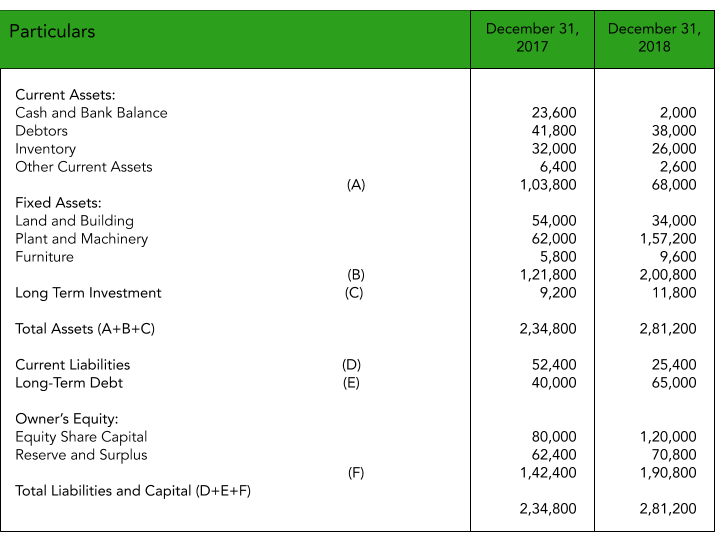

How do you classify costs on functional basis?

1 Costs should be classified according to the major functions for which the elements are used into the following four major functions : Production; Administration; Selling; Distribution; and Research & Development Expenditure.

The process of cost accounting benefits by helping us to discern this. Preliminary Cost – costs incurred before the commencement of the actual business e.g. rent, interest, product trial, underwriting costs etc. Variable Cost – It is the cost of variable inputs used in production. Fixed Cost – It is the cost of fixed inputs used in production. These costs do not vary with the change in volume of production.

Marginal Cost

Centralization of cost control activities and adoption of cost cutting programs. Moving of production to other places, which will increase cost instead of decrease in costs. Labour cost concepts and classifications comprises of the wages and salaries paid to temporary and permanent workers for goods manufacturing. Manufacturing and ProductionCosts are costs involved in manufacture, construction and fabrication of products.

Avoidable costs are the costs that could have been escaped or eliminated under any given condition of performance efficiency. Unavoidable costs are the costs that are essential and could not have been escaped or eliminated from its occurrence. This cost arises when one alternative is rejected or sacrificed to use another alternative. It depends upon the managerial decision to give up on one alternative to choose something else.

Different Types of Cost

There can be further sub-classification of these; for example, material into raw material, components, maintenance material, etc. Classification of Cost is the process of arranging costs according to their common characteristics. It is the logical placement of like items together according to their common features. This cost includes the salary and wages paid to temporary and permanent employees for the manufacturing of the goods. Determination of ‘cost driver’ for each activity that may be used as cost application base.

Direct Costs – These are those costs which are incurred for and conveniently identified with a particular cost unit, process or department. Cost of raw materials used and wages of machine operator are common examples of direct costs. To be specific, cost of steel used in the manufacturing a machine can be conveniently known.

Benefits of Cost accounting

Abnormal Cost – It is the cost which is not normally incurred at a given level of output under normal conditions. It is an irregular cost which would not exist in ideal conditions. Normal Cost – It is a cost which normally incurred in achieving a certain level of output under certain conditions. Imputed cost – These are hypothetical costs which are considered just for the purpose of decision making and do not involve any actual cash outflow. Sunk Cost – It is the cost which is not altered by a change in current business activity.

- The batches can be to fulfil a particular order, or they can be for a predetermined quantity.

- ABC system will report on the resource spending vis-a-vis resource consumption, and reduced demand in organizational resources lead to increase in profits.

- Coal, lubricating oil and grease, sand paper used in polishing, soap, etc.

- So, this cost is classified as production, administration, selling, etc.

- Social Cost – It refers to the cost of hardships and sacrifices that a society has to bear due to operation of business activities.

Cost for analytical and decision-making purposes (Opportunity, Sunk, Differential, Joint, Common, Imputed, Out-of-pocket, Marginal, Uniform, Replacement). Revenue cost is the cost that is incurred for the maintenance of the revenue earning capacity of the business. In a steel plant, the purchase of a rolling machine is an investment. The cost of consumable stores, the salary of a foreman or supervisor, rent of the factory, etc.

On the basis of information provided by ABC, effective measures can be adopted for cost cutting. The number of sales invoices drives the costs of the sales, despatch and sales ledger activities. To identify the opportunities for improvement and reduction of costs. To provide high quality information about activities, customers, non-manufacturing activities.

What is cost based on function?

The general form of the cost function formula is C(x)=F+V(x) C ( x ) = F + V ( x ) , where F is the total fixed costs, V is the variable cost, x is the number of units, and C(x) is the total production cost.

It involves computation of historical cost i.e. the cost which has already been incurred. Different methods are there to ascertain cost depending upon the needs of individual methods like job costing, contract costing, process costing, operating costing etc. Indirect labour – It is of a general character and cannot be conveniently identified with a particular cost unit. In other words, indirect labour is not directly engaged in the production operations but only to assist or help in production operations. These costs are incurred so that physical and human facilities necessary for business operations can be provided.

Pins, screws, nuts and bolts, thread, etc. those items which do not physically become a part of the finished products; e. Coal, lubricating oil and grease, sand paper used in polishing, soap, etc. All in all the expense for producing a final product is known as Production cost.

Brain Stimulation Can Improve Prognosis Following a Stroke and … – Medscape

Brain Stimulation Can Improve Prognosis Following a Stroke and ….

Posted: Tue, 28 Mar 2023 19:07:36 GMT [source]

on the basis of functions cost is classified as Cost is the cost of any material we employ in the generation of goods. For instance, let us divide the material cost into the cost of raw material, spare components, costs of material for packaging, etc. These costs are determined prior to production on the basis of actual cost and the factors affecting the cost. Predetermined costs made on a more or less scientific basis result in a standard cost. These costs are not normally occurring at a particular level of output in conditions in which normal levels of output happen. These costs are calculated according to the profit and loss account; they are not a part of the production cost.

Fixed cost is that cost that is not affected by any variation in the volume of output. The amount of fixed cost tends to remain constant for all volumes or production within the fixed capacity of the plant. The investor or owner of the business has to keep a record of the total money he has spent for the various operations in the business. It can be for anything required to start and establish any enterprise up to gaining of the final profit. Under this topic, we will learn and identify various expenditures that are incurred while running any business endeavor.

On which basis cost is classified as?

1] Classification by Nature

So basically there are three broad categories as per this classification, namely Labor Cost, Materials Cost and Expenses. These heads make it easier to classify the costs in a cost sheet. They help ascertain the total cost and determine the cost of the work-in-progress.

A controllable cost can be controlled by a person at a given organizational level. Some costs are partly controllable by one person and partly by another e.g., maintenance cost can be controlled by both the production and maintenance manager. The term “controllable costs” is often used to mean variable costs and non-controllable costs as fixed. It is the variable cost that comprises the major cost and variable cost. It is incurred when there is an increase in the volume of production. Costs which can be directly identified with cost centres, processes or production units are direct costs.

Product costs are included in the cost of the product and do not affect income till the product is sold. Period costs are charged to the period in which they are incurred. This cost is normally incurred at a given level of output in the conditions in which that level of output is normally attained. Such a classification is very important for cost control and cost reduction. It depends on the management to identify the areas where the costs can be controlled and reduced. This is a cost that varies directly with variations in the volume of output.

The definition of cost classification is the process of dividing a company’s costs into various categories for the decision-maker to have a clear understanding of the spending patterns. Because of this, teams can effectively use the data for financial modelling and accounting purposes. It helps management to determine which cost is more crucial than the others.

Which of the following is a cost classified based on function?

Classification by function. Classification by function involves classifying costs as production/manufacturing costs, administration costs or marketing/selling and distribution costs. In a 'traditional' costing system for a manufacturing organisation, costs are classified as follows: Production or manufacturing costs.