BECU will not provide a certain period of time private loan financing, in the event individuals can generally predict the method to take anywhere from a couple working days so you’re able to each week. Centered on BECU’s web site, financing decision was generated in 24 hours or less for the majority consumers. When you indication your loan contract, their finance would be deposited into the BECU membership.

After recognized, your own loan financing might possibly be digitally transferred directly into your own present BECU account. Alternatively, when you find yourself utilising the loan to have debt consolidation, you can consult to possess BECU publish your loan funds privately towards the financial institutions.

Borrower Conditions

BECU will not divulge the debtor standards so you’re able to be eligible for your own loan. After you get an unsecured loan which have people lender, you’ll have to read a hard credit inquiry to determine whenever you are qualified. Predicated on BECU customer care, the financing partnership accepts credit scores only 600, and you will individuals which have good or sophisticated credit get the best options off acceptance.

Other qualifications criteria you to definitely personal loan lenders normally have are facts regarding work or some other source of income, a minimum quantity of earnings, an optimum debt-to-money ratio, and much more.

BECU Consumer loan Have

- Mortgage re also-rates program: BECU evaluations its customers’ membership per year, whenever your credit rating advances and you can you have made consistently fast money, BECU get reduce the interest rate of your own financing. If for example the loan is already costing the credit union’s reduced rates, you will never found a reduction.

- Financing commission safety program: Borrowers should buy borrowing insurance that may bring investment such as just like the smaller monthly financing repayments through the a career loss or any other disaster.

- Collector head spend: If the personal loan is for debt consolidation reduction, BECU will pay your creditors really, that is a benefits to you, and you can a little bit of risk avoidance to suit your lender.

Co-Signers and you may Co-Candidates

Whether you are seeking express the burden of your the fresh loan with your partner or need to put a good creditworthy co-borrower so you can potentially availability finest financing terminology, BECU enable it. Both combined apps and you can co-signers was desired.

Refinancing a personal bank loan will likely be one good way to decrease your rate of interest, decrease your monthly premiums, step out of loans in the course of time, or all the about three.

While you are BECU does not indicate whether existing unsecured loan people is refinance, it does from time to time review members’ fico scores. When your credit has actually improved because you grabbed out your individual mortgage, you might earn a far greater price without having to formally refinance your loan.

Customer service

Professionals throughout the You.S. and you will Canada is contact BECU by the mobile phone throughout the prolonged business hours, and a 1 / 2-go out into Saturdays. You could post send-together with your consumer loan statement-to BECU’s Seattle area.

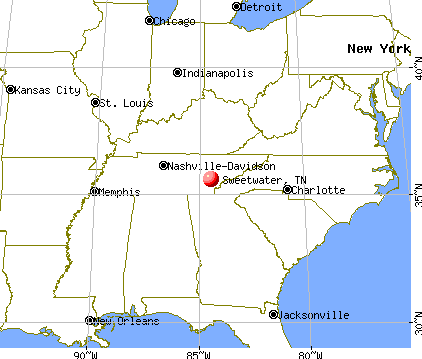

When you find yourself local to 1 out-of BECU’s stone-and-mortar twigs, you can stop by to speak with a loans Upper Witter Gulch CO real estate agent concerning your personal loan, registration, or anything. BECU has several social networking avenues, it says are often used to sit up-to-big date on associate offers, development, and you will notices.

Client satisfaction

Boeing has actually mixed reviews from the customers. The financing connection possess a get of 1.8 of 5 a-listers towards the Trustpilot and you will 1.thirty six out of 5 stars into the Bbb, in which this has a the+ rating. Members claim that it can take a long time so you can processes certain purchases, eg purchasing checks otherwise bringing an email response out-of buyers service. But full, extremely users appear satisfied with BECU’s lending products.

BECU also offers more than 140 issues to the Consumer Economic Shelter Agency. People report situations and work out money towards certain mortgage activities, negative or threatening range means, financial errors, and a lot more.