Others situation you may have is that on nine percent of the many house when you look at the Allegheny County is unused nowadays. Discover a giant backlog out of a home inventory around, and you will financial businesses are permitting an abundance of functions remain unused. That is enormously hard, because if you may have registered bankruptcy proceeding and you can «surrendered» your home, you simply can’t assume that mortgage lender have pursued a foreclosures. Where circumstances, youre nevertheless the newest legal holder of the home and your local township will demand which you maintain the assets! So, I really like the fact you have got stayed throughout the assets for the moment. Let me know when you have even more questions.

Thank you for answering. I do not live-in Allegheny state however, I would think they is similar every-where. Wouldn’t I get a notice that he’s got foreclosed or why do We become out of our home? I mean no sarcasm merely alarmed. I have a pal (seriously) who’s looking to purchase through short purchases while the family citizens come into the house for almost 1 . 5 years and you may nevertheless relying in place of and work out a cost. That’s an estimate to date. This couple is additionally dealing with sale of the family like that. Just what are your opinions? It appears that it’s been getting financial institutions extended to help you foreclose. Now i’m most alarmed and would rather a preliminary product sales as i just remember that , has an effect on the credit for two many years against. 7. Now because I have registered personal bankruptcy my personal borrowing from the bank is ruined to possess eight many years. My personal situation concerns which i ran from a two-income where you can find my personal money by yourself. It is simply an excessive amount of for me personally to complete.

Bc im nonetheless in the home but cannot pay the financial. Because of the reduced amount of myincome. We havent heard from the loan providers(Phfa).the been 6months.It will not come back my calls and that i don’t know if i am for the property foreclosure or perhaps not. They havent sent people noticed.Can they merely lay me away?

My house is within Lebanon Condition, bad credit no credit check payday loans in Westover PA. It has been on the market given that July having absolutely no appeal. Our house no longer is filled due to the fact I would not also afford so you can temperature they. Currently 3 months trailing towards mortgage. You will find now injury to the house as a result of the artic temperatures there is gotten leading to breaking pipelines. My real question is, if this ends up getting foreclosed, is also the borrowed funds business return into me when it comes down to away from these damage? Were there will set you back so you’re able to an us pertaining to a property foreclosure?

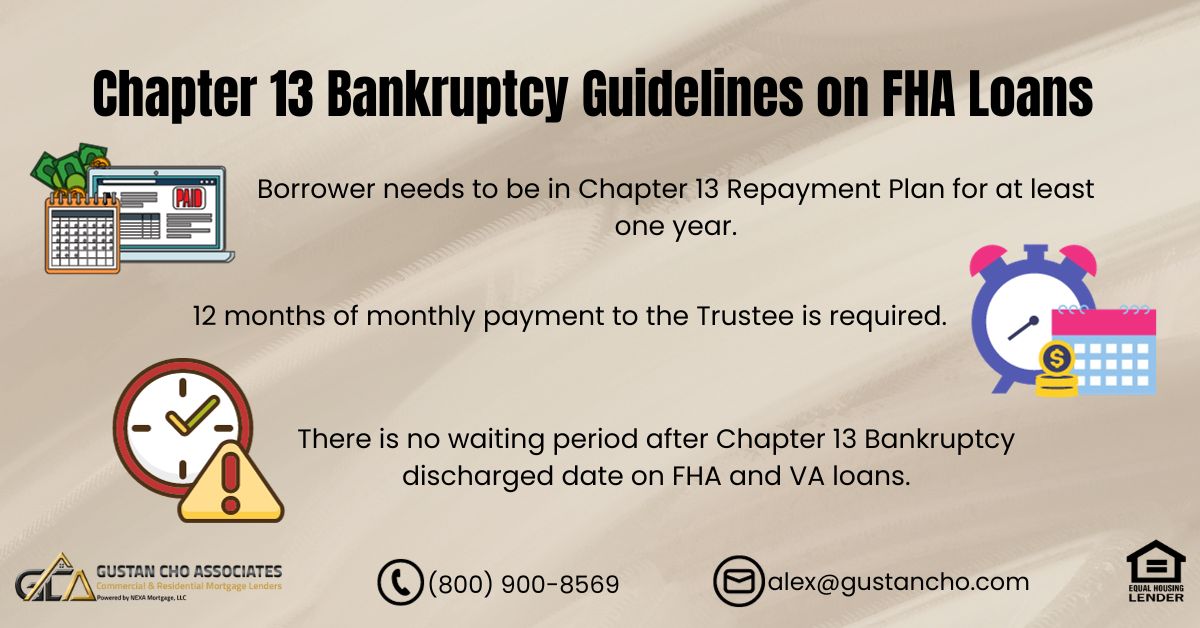

We submitted a chapter thirteen already ,i quickly registered for a financial loan modification

We have someone who is trying so you’re able to lease his house. The guy told me your home is preparing to wade towards foreclosure plus it you’ll draught beer any where from dos-4 ages getting Tye foreclosure processes. The cost of rent appears alil too good to be real. How could We knw if this sounds like a scam or not. Can i temp make the home otherwise ought i run the newest other means? Excite help me to.

I am aware the problem is exclusive for the reason that they own a couple home perhaps from exact same bank and therefore are just promoting you to definitely

Responding to Gina, you should probably hire a legal professional to investigate new applicants off the fresh new property foreclosure. I’m not sure exactly how someone can be remember that brand new foreclosures process is going to need 2 to 4 age. Why? Including, when it house is when you look at the Allegheny Condition, I’d manage to tell exactly what the standing of one’s foreclosure try, however, We wouldn’t be able to assume it may get two to four ages. You to definitely seems like an absurd declaration. I would become very cautious easily have been you, Shawn Wright