What is a mortgage lien?

Home financing lien are a legal bargain between your lending company; it’s among the many documents you finalized after you signed on your own home loan. The local county recorder’s place of work has actually they toward file, plus it confirms your financial ‘s the true manager out-of your house if you do not pay back your loan. This new lien brings your bank the ability to take your possessions if not repay your own home mortgage. The fresh lien also prevents you against offering otherwise move your house so you can other people if you don’t pay-off your loan in full-otherwise anyone else lawfully takes on the responsibility to blow their financial.

What’s a beneficial lien launch?

A good lien discharge takes place when the bank (the latest lienholder) releases the claim to your home (often referred to as lifting otherwise waiving this new lien). Based on your geographical area, the latest document one to shows your own financial keeps put-out the allege is actually named a great discharge of lien otherwise good certification regarding pleasure. From the finalizing the lien launch, their financial was confirming which they no longer have judge state they your residence.

If you promote your house or lawfully transfer they to individuals else, your loan servicer should be active in the promoting way to make sure the lien try safely create otherwise directed before you can complete the purchase.

Why does the fresh lien-launch procedure really works?

After you pay back your loan if you’re the audience is maintenance they, we are going to pay your financial and make sure it indication a great launch of lien/certificate of pleasure. In your lender’s account, we’re going to upload that file towards the local condition recorder or belongings info work environment. Immediately following nearby work environment suggestions they and you may production it to help you us, we’re going to publish the brand new document to you.

For folks who offer your residence before you can pay-off your mortgage loan, your own label business pays their lender and you can employs up to make certain they release their lien.

What will happen if i refinance my financing?

As with attempting to sell your property, once you refinance, their term providers pays their lender and you can ensures new financial launches the lien on your property.

For individuals who re-finance the loan compliment of Ny country’s CEMA program, we send all mortgage files towards holder regarding payday loans online Delaware your brand new financing.

I’ve delivered you a check to repay my personal mortgage loan completely. Should i do anything else?

Once we found your own rewards look at, on the behalf of the lender we’ll send a great lien discharge file (and therefore confirms their benefits) with the regional county recorder or home information office inside 29 business days immediately following your payoff date (sooner or later in certain states). However, based on where you happen to live, it might take over thirty day period to suit your regional place of work so you can list the fresh document and you will send it back in order to all of us. Regardless of how a lot of time the fresh recording process requires, we shall deliver this new registered document after we located they.

You will find reduced my personal house-security personal line of credit; it presently has a zero balance. What do I want to do?

Your account might have a no equilibrium, however, that does not mean their financial enjoys released the lien on your house. You really need to give us a demand written down. Whenever we found the demand, we’ll personal your account. Shortly after your bank account are closed, we’re going to ready yourself and you will posting an excellent lien launch with the state recorder’s workplace.

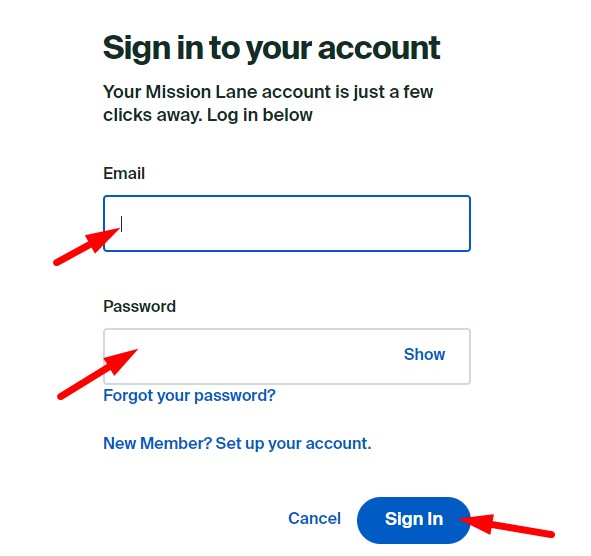

Fill out the consult by the signing into your membership on our very own webpages and going to the Contact us point. You can also send your consult so you can:

We post records in order to the emailing address we have to the file for your. If you has just gone, log in to your bank account with the the website right away and you can update your emailing target.

We reduced my mortgage while it are addressed by the my prior servicer. Can you help me score a good lien launch?

For folks who paid the loan because of a unique mortgage servicer-particularly Ditech, GreenTree, GMAC, or any other home loan servicer-we can not make it easier to receive good lien discharge once the i failed to solution the loan.

If you have paid off home financing with the a produced family, we very first have to receive your own mortgage document document (or collateral file) from your file caretaker (the firm we used to store and you will safeguard this new physical home loan files into the fund i solution). You to definitely procedure alone takes up to a month, and you may need certainly to make it all in all, 3 months just after rewards for people to transmit your your put-out title.

But if you you desire me to issue an effective lien launch ahead of we become your own equity file, that’s possible. You’ll want to give us an effective DMV or state identity research you to definitely listing the second information in detail:

- House pointers (for instance the residence’s target)

- Homeowner pointers (like the full brands, latest address, and newest phone numbers of all of the parties on the files) due to the fact found towards identity

- Lienholder (lender) information (also full courtroom label, address, and you may contact number) given that revealed toward name

- Are formulated domestic or automobile VIN/serial amount, season, generate, and you will model number.

We’re going to make use of the recommendations you send me to prepare yourself an exact lien launch. Post their name-lookup file along with your demand to help you

A UCC-step 1 (Consistent Industrial Password) report filing is necessary after you purchase shares out-of stock so you can very own a beneficial co-op flat in a few urban centers (instance New york). The new UCC-step 1 statement functions as a good lien to your apartment, and that means you are unable to offer your shares as opposed to first settling the mortgage.

Once you offer your own co-op equipment or pay-off the loan one financed you buy, the loan servicer or bank will signal a beneficial UCC-3 cancellation statement and you may file it towards state clerk during the new condition in which their device is based (into the New york, it’s submitted with the Town Check in). If it is filed, the new UCC-step 3 report launches your own lender’s lien on your own co-op.

As with a created home, to complete your own lien launch, we have to receive your own document (or collateral) file from your file caretaker (the business we use to shop and safeguard the fresh report records with the money we solution). One to processes by yourself can take to thirty day period, and you’ll need enable it to be a maximum of ninety days immediately after benefits for us to help you processes your own stock and you may lien-discharge data files. We have fun with an excellent lien-discharge merchant so you’re able to cancel UCC filings inside conformity with county-required timelines.

You can check in to the web site to see if the lien release can be found. Get a hold of Online Services and you may chosen Offered Documents. The unrecorded and you may registered lien discharge (or satisfaction document) come after we discovered all of them from the condition recorder’s workplace.